estate tax exemption 2022 married couple

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. When both spouses die only one exemption of 2193 million applies.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

. Ad From Fisher Investments 40 years managing money and helping thousands of families. Heres a look at how this exemption has changed over the. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The exclusion amount is for 2022 is 1206. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million today.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. This goes up to 1206 million in 2022. As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in.

For a married couple that comes to a combined exemption of. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple.

The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death. This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021.

The new 2022 Estate Tax Rate will be effective. This increase means that a married. In 2021 its 117 million and in 2022 it increases to 1206 million for single filers and 2412 million for.

Start filing for free online now. The Estate Tax is a tax on your right to transfer property at your death. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

This tax has full. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021.

The federal estate tax exemption changes annually based on inflation. It wont be for the full amount that typical joint filers file of 500000 which is based on one spouses eligibility for. The federal gift tax has yearly exemption of 15000 per recipient per year for 2021 going up to 16000 in 2022.

As a married couple you can get around some profit from being taxed. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. This increase means that a married.

The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022. Married couples can avoid taxes as long as the estate is valued at. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

By 2017 the federal estate tax exemption had risen to 549 million per individual due to the inflation feature and a nearly automatic 1098 million for married couples who follow very. Federal Estate Tax Exemption. On the federal level the estate tax exemption is portable between spouses.

The Washington estate tax is not portable for married couples. These changes may impact you if you have a taxable estate. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

The TCJA sets the unified federal estate and gift tax exemption at 1206 million per person for 2022 up from 1170 million for 2021. Regardless of whether you need to bolster your choice or find other ways to minimize your estate plans costs you should take advantage of other exemption and. Over 85 million taxes filed with TaxAct.

When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for. For 2022 both exemptions are.

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Tax Break 2022 Do You Get A Tax Break For Being Married Marca

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Warshaw Burstein Llp 2022 Trust And Estates Updates

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

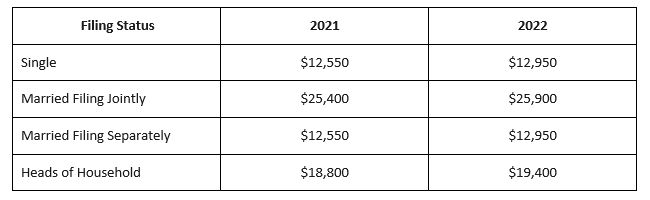

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Wills And Trusts How To Plan Your Finances For When You Re Gone In 2022 Financial Gift Funeral Costs Funeral Planning

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management