idaho sales tax rate by county

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The state sales tax rate in Idaho is 6000.

Iowa Sales Tax Small Business Guide Truic

The minimum combined sales tax rate for Las Vegas Nevada is 838.

. Click here for a larger sales tax map or here for a sales tax table. With local taxes the total sales tax rate is between 6000 and 8500. This table shows the total sales tax rates for all cities and towns in Westchester.

New York has a 4 sales tax and Westchester County collects an additional 4 so the minimum sales tax rate in Westchester County is 8 not including any city or special district taxes. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales. Help us make this site better by reporting errors.

Always consult your local government tax offices for the latest official city county and state tax rates. Prescription Drugs are exempt from the Idaho sales tax. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074.

The jurisdiction breakdown shows the different sales tax rates making up the combined rate. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted. The County sales tax rate is 378.

Combined with the state sales tax the highest sales tax rate in Idaho is 9 in the city of Sun Valley. In determining market value for a home the assessor typically uses sales price data for recently sold homes that are comparable in terms of size location condition and other distinctive features. The effective rate for every county in Idaho as well as county-specific median real estate tax payments and median home values.

The total sales tax rate in any given location can be broken down into state county city and special district rates. While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates.

The Las Vegas sales tax rate is 0. The Nevada sales tax rate is currently 46.

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

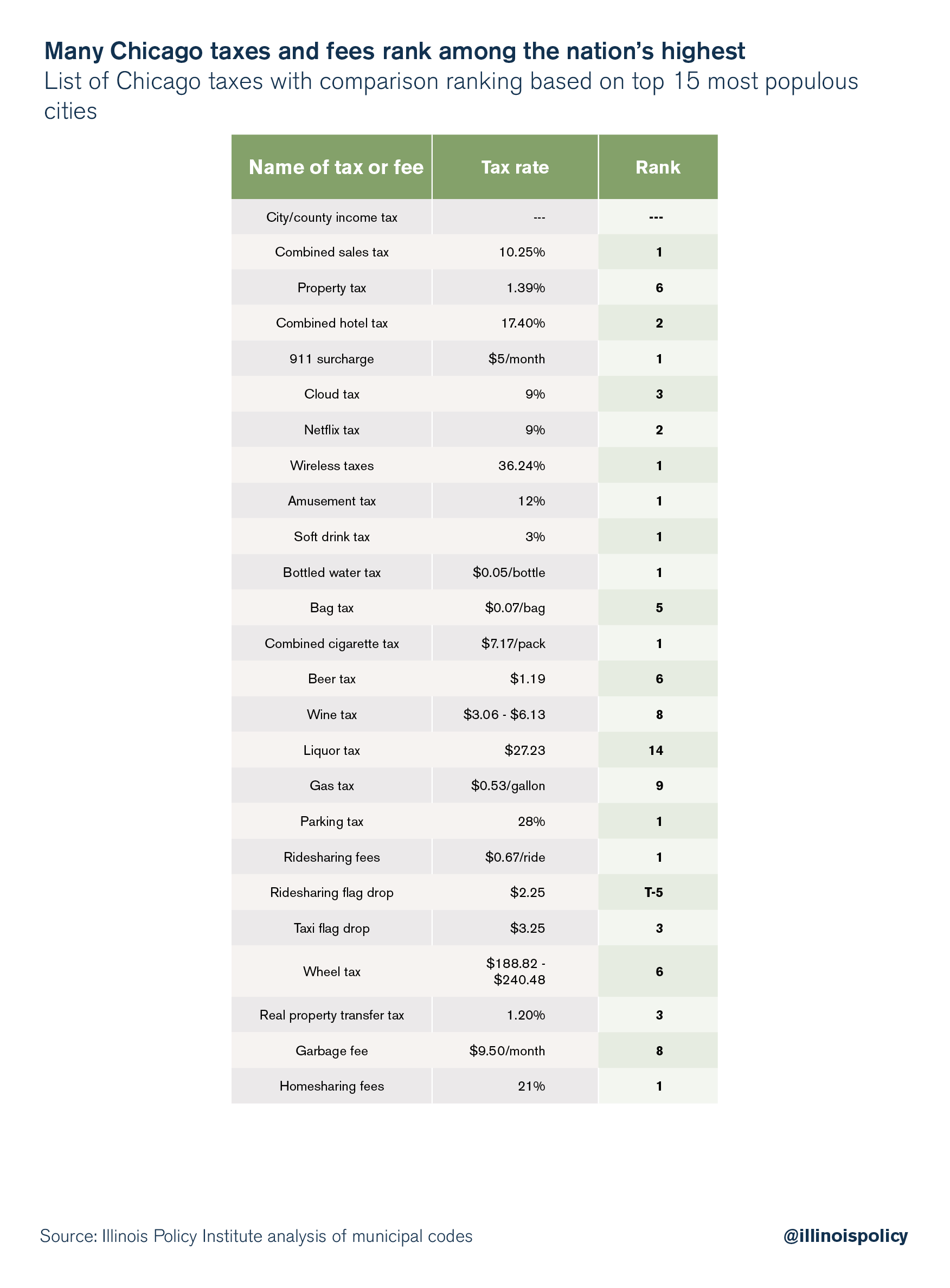

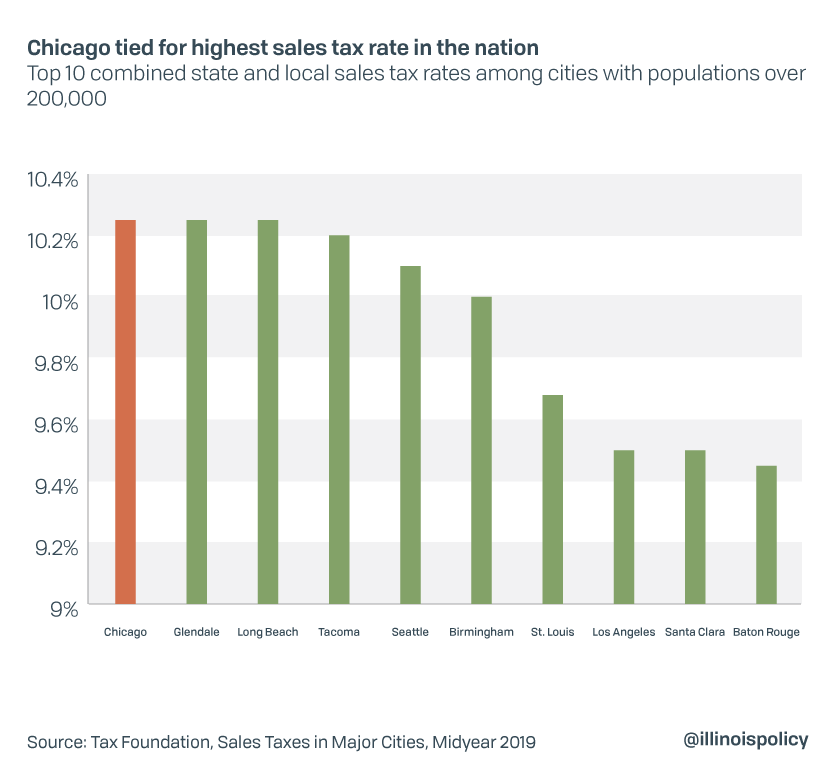

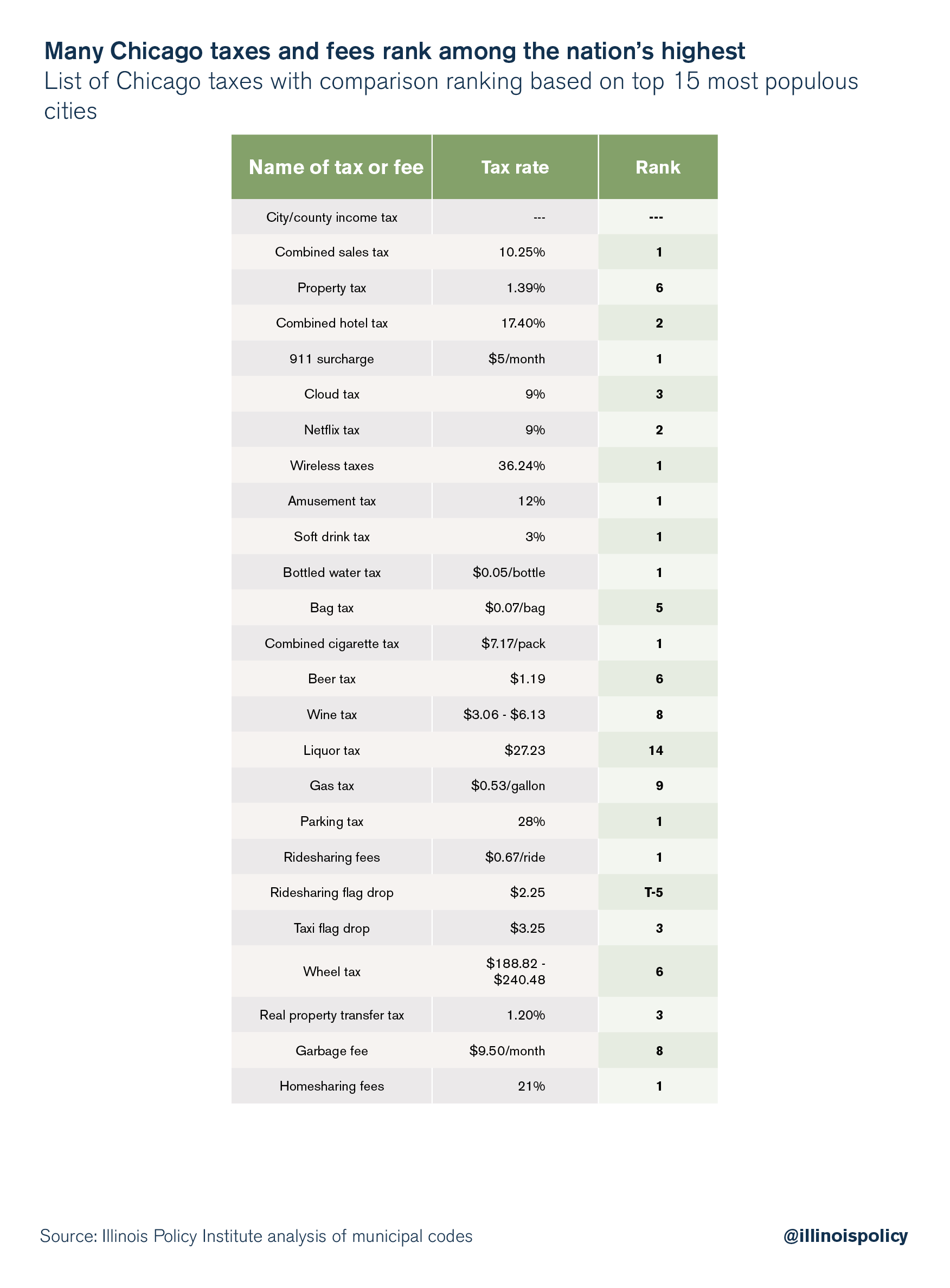

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Historical Idaho Tax Policy Information Ballotpedia

Idaho Sales Tax Rates By City County 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Kootenai County Property Tax Rates Kootenai County Id

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Idaho Property Taxes Everything You Need To Know

How High Are Cell Phone Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho